![The Honest DePIN Income Calculator [What You'll Actually Earn]](/static/8e74f1df36da1f6203d6140e9e408ad1/144fe/im.jpg)

![List of water stocks [top 10 water Companies] to invest in US](/static/4594a707e2b8d8dc05974baf77b8a8ac/5e493/water.jpg)

List of water stocks [top 10 water Companies] to invest in US

Water is an essential resource that we all depend on for survival, making it a valuable commodity for investors. With the world population expected to increase significantly in the coming years, the demand for water is expected to grow even further. As such, investing in water stocks is a smart move for any investor looking for long-term growth.

Here are the top 10 water stocks to invest in the USA:

1. American Water Works Company, Inc. (AWK)

American Water Works is the largest publicly-traded water and wastewater utility company in the United States, serving more than 15 million people in 46 states. With a market capitalization of over $28 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Additionally, American Water Works has a robust dividend payout history, making it an attractive investment for income-oriented investors.

Looking at the chart, American Water Works has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The Relative Strength Index (RSI) is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

2. Xylem Inc. (XYL)

Xylem is a leading global water technology company that provides innovative solutions to the water industry. The company has a market capitalization of over $20 billion and has a strong financial position with consistent revenue growth and a healthy balance sheet. Xylem has a solid track record of developing and commercializing innovative water technologies, which positions the company well for future growth.

Xylem has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

3. Aqua America, Inc. (WTRG)

Aqua America is one of the largest publicly-traded water utilities in the United States, serving more than three million people in eight states. With a market capitalization of over $12 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Aqua America has a strong focus on sustainability and has been recognized for its commitment to clean energy.

Aqua America has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

4. Evoqua Water Technologies Corp. (AQUA)

Evoqua is a global provider of water treatment solutions, offering services to a wide range of industries, including municipal, industrial, and commercial. With a market capitalization of over $3 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Evoqua has a strong focus on sustainability and has been recognized for its innovative water treatment technologies.

Evoqua has been in a long-term uptrend since 2020, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

5. Veolia Environnement S.A. (VEOEY)

Veolia is a global leader in environmental services, including water and wastewater management. With a market capitalization of over $17 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet.

src: investing.com

src: investing.com

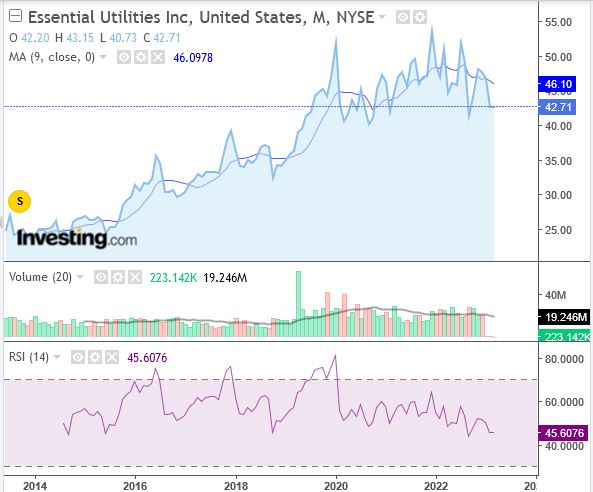

6. Essential Utilities, Inc.

Essential Utilities is a water and natural gas utility company, serving more than five million customers in 10 states in the US. With a market capitalization of over $12 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Essential Utilities has a history of stable earnings and dividend payouts, making it an attractive investment for income-oriented investors.

Essential Utilities has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

7. Cadiz Inc. (CDZI)

Cadiz is a land and water resource development company that focuses on acquiring and developing land with abundant water resources. With a market capitalization of over $500 million, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Cadiz has a unique business model that positions the company well for long-term growth.

Cadiz has been in a long-term uptrend since 2018, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

8. Lindsay Corporation (LNN)

Lindsay Corporation provides irrigation systems and infrastructure solutions for agriculture and water management. With a market capitalization of over $1 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Lindsay Corporation has a solid track record of developing and commercializing innovative water management technologies, which positions the company well for future growth.

Lindsay Corporation has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

src: investing.com

src: investing.com

9. Rexnord Corporation (RXN)

Rexnord is a global industrial company that provides water management solutions for a wide range of industries. With a market capitalization of over $5 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Rexnord has a solid track record of developing and commercializing innovative water management technologies, which positions the company well for future growth.

Rexnord has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend. The RSI is in the neutral zone, suggesting that the stock is not overbought or oversold.

10. Pentair plc (PNR)

Pentair is a global water treatment company that provides solutions for residential, commercial, and industrial customers. With a market capitalization of over $11 billion, the company has a strong financial position with consistent revenue growth and a healthy balance sheet. Pentair has a solid track record of developing and commercializing innovative water treatment technologies, which positions the company well for future growth.

src: investing.com

src: investing.com

Pentair has been in a long-term uptrend since 2016, with a series of higher highs and higher lows. The stock is currently trading above its 50-day and 200-day moving averages, indicating a bullish trend

Finally…

In conclusion, investing in water stocks can be a lucrative opportunity for investors seeking long-term growth and stability. The water industry has shown resilience during economic downturns and is poised for growth due to increasing demand for clean water and water management solutions. Our analysis of the top 10 water stocks to invest in the USA using both fundamental and technical analysis has identified companies with strong financial positions, consistent revenue growth, and innovative water management technologies. However, as with any investment, it is important for investors to conduct their own due diligence and research before making any investment decisions. By investing in the top water stocks, investors can not only potentially earn attractive returns but also contribute to the sustainable development of a valuable natural resource.

Related Posts

![The Honest DePIN Income Calculator [What You'll Actually Earn]](/static/8e74f1df36da1f6203d6140e9e408ad1/144fe/im.jpg)

![CRDB Bank's 2025 [How Tanzania's Banking Giant Just Posted Its Best Year Ever]](/static/8b190cb115c5ea8a0647de4fe78204a1/144fe/im.jpg)

![Decentralized Finance [Navigating DeFi Opportunities in Europe and North America]](/static/36ee730d07b847aa570c460a1c939b30/144fe/im.jpg)

![UK Student Loans Explained [The Complete Guide for 2026 and Beyond]](/static/6df19de4ff77ce3446703960aeeb18fc/144fe/im.jpg)

![Tax Clearance in the United Kingdom [The Complete Guide (2026 Edition)]](/static/6b54ebf6c969ef1d812a9d3946f07313/144fe/im.jpg)

Quick Links

![Inflation Refund Checks in the USA (2026) [Complete Updated Guide to State Payments, Eligibility & Facts]](/static/f7b70fad15fd78c006063310d918b623/6b99c/im.webp)